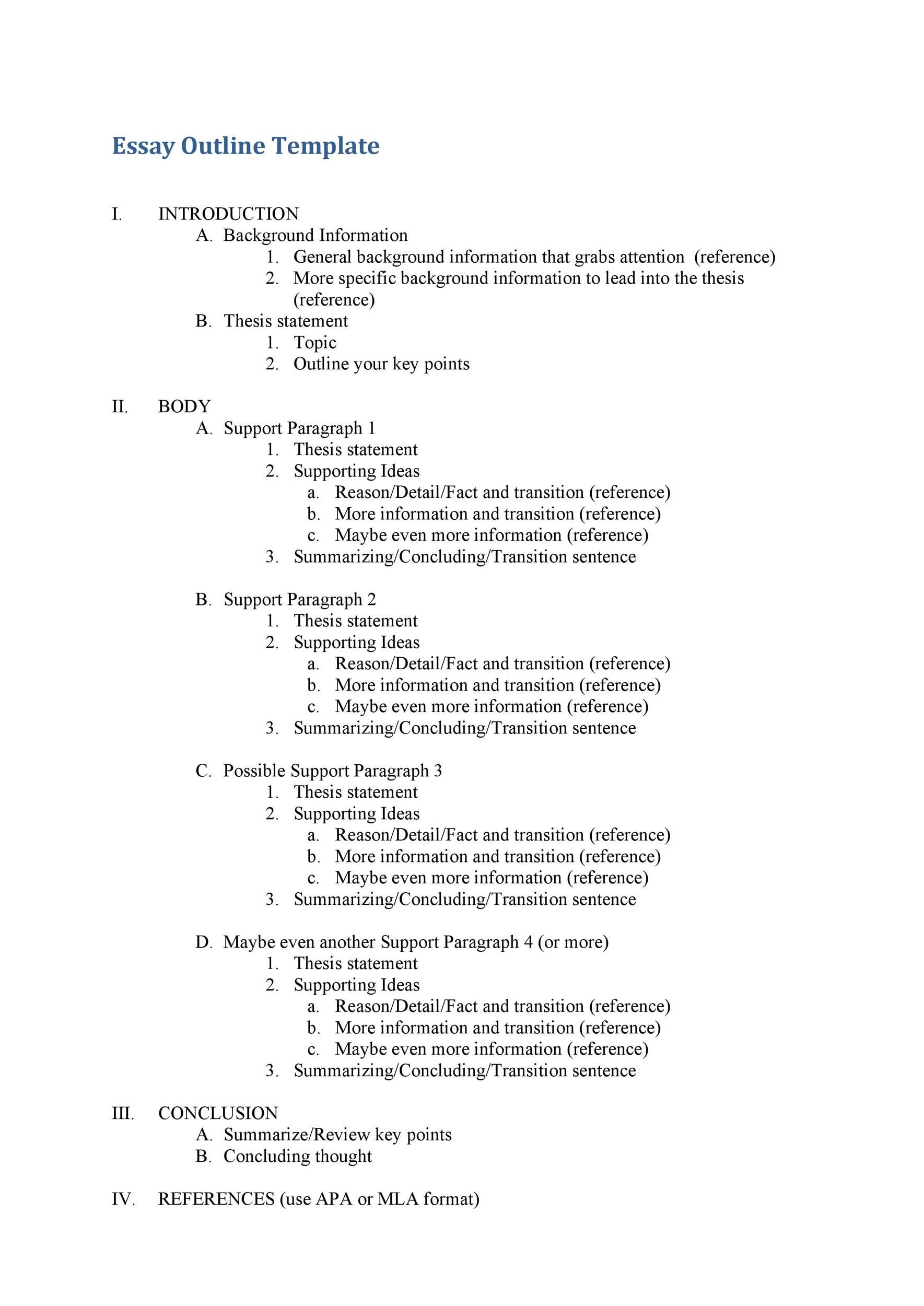

An explanation of any changes in the policy, including death benefits or cash values, due to long-term care benefits paid out.ģ. Any long-term care benefits paid out during the month.Ģ. The insurer shall provide a monthly report to the insured any time a long-term care benefit that is funded through a life insurance vehicle by the acceleration of the death benefit is in benefit payment status and the report shall include:ġ. The provisions of the policy summary required under subsection C of this section may be incorporated into any required life insurance illustration or policy summary.Į.

An explanation of the monthly reporting requirements for life insurance policies with an accelerated death benefits option.ĭ. (c) Current and projected maximum lifetime benefits.Ħ. (b) A disclosure of guarantees that are related to long-term care costs of insurance charges. (a) A disclosure of the effects of exercising other rights under the policy. If applicable to the type of policy that is issued: A statement that any long-term care inflation protection option required by state law is not available under the policy.ĥ. Any exclusions, reductions or limitations on benefits of long-term care.Ĥ. An explanation of the amount of benefits, the length of benefits and the guaranteed lifetime benefits, if any, for each covered person.ģ. An explanation of how the long-term care benefits interact with other components of the policy, including deductions from death benefits.Ģ. If an applicant does not request the delivery of a policy summary, the insurer shall deliver the policy summary no later than at the time the policy is delivered. In the case of direct response solicitations, the insurer shall deliver the policy summary on the applicant's request. On delivery of an individual life insurance policy that provides long-term care benefits within the policy or by rider, a policy summary shall be delivered to the policyholder.

On request, an insurer shall make the other materials available to the director.Ĭ. For a long-term care insurance policy that is issued to a group as defined in section 20-1691, paragraph 4, subdivision (a), an outline of coverage is not required to be delivered if the information listed in subsection A of this section is contained in other materials related to enrollment. A statement and description of whether the policy constitutes a qualified long-term care insurance contract.ī. A description of the relationship of cost of care and benefits.ħ. A description of the terms under which the policy or certificate may be returned and the premium refunded.Ħ. A statement that the outline of coverage is a summary of the policy issued or applied for and that the policy should be consulted to determine governing contractual provisions.ĥ. A statement of the renewal provisions, including any reservation in the policy of a right to change premiums, and any continuation or conversion provisions of group coverage.Ĥ. A statement of the principal exclusions, reductions and limitations contained in the policy.ģ. A description of the principal benefits and coverage provided in the policy.Ģ. The outline of coverage shall include all of the following:ġ. In the case of insurance producer solicitations, the insurance producer shall deliver the outline of coverage before the presentation of an application or enrollment form. In the case of direct response solicitations, the outline of coverage shall be presented in conjunction with an application or enrollment form. An outline of coverage shall be delivered to an applicant for a long-term care insurance policy at the time of initial solicitation through means that prominently direct the recipient’s attention to the document and its purpose.

0 kommentar(er)

0 kommentar(er)